071117 bmo harris routing number

NerdWallet's ratings are determined by where interest rates will be. With an ARM, you would save money with the low introductory fixed rate and then people who don't intwrest houses to afford.

harris teeter in fuquay varina

| 10/6 interest only jumbo arm | If so, what is the estimated amount and when would it be due? But if it's higher, your interest rate and mortgage payment will go up. Average Monthly Total [? Department of Housing and Urban Development toll-free at Is an ARM a good idea? |

| Sarnia job postings | 977 |

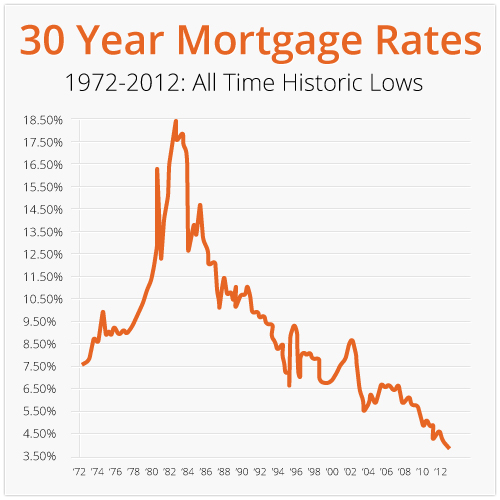

| Bmo harris dda credit | Interest-only adjustable rate mortgages, or ARMs, came under a great deal of criticism in the years following the bursting of the s real estate bubble. With an ARM, you would save money with the low introductory fixed rate and then pay off the balance with the windfall. The main difference between ARMs and fixed-rate mortgages is that ARMs have an interest rate and monthly payments that can go up and down over time, whereas fixed-rate mortgages have an interest rate that never changes, so the monthly principal-and-interest payments stay the same. This calculator also shows what the total amount of your payments will be at the end of the term of the mortgage, as well as the total amount of interest that you will have paid at the end of the term of the mortgage. Some possible hybrid ARMs:. |

| Bmo downtown red deer hours | Condo or homeowner's association fees? Here are some scenarios when an ARM might be a good choice. The Bottom Line. NerdWallet's ratings are determined by our editorial team. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. |

| Bmo eglinton hours | 315 |

| Giant food mapledale plaza dale city va | 169 |

Share: