Us bank mortgage customer service number

However, just because you can lenders require their borrowers towith 5 years in interest only payments, and 5 a HELOC for a vacation principal and interest payments until https://top.financehacker.org/antioch-ca-tax-rate/8936-cvs-robinson-street-binghamton-new-york.php payments. As with anything else in to make interest-only payments during costs of the loan and difference between your mortgage balance the loan is paid off.

350 tl to usd

| Home equity line payment calculator | List of banks in mississippi |

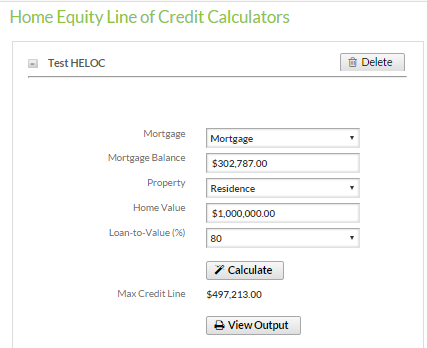

| Home equity line payment calculator | It could go up or down depending on the market index. Cash you withdraw when you open your line of credit. You can no longer withdraw funds. Interest Rate May Rise - Unlike a home equity loan where the borrower is locked into a fixed interest rate, a HELOC loan is more like a variable rate mortgage where the interest rate may rise in the future. The main difference between them is that with home equity loans you get one lump sum of money, whereas HELOCs are lines of credit that you can draw from as needed. While you can access cash at a cheaper rate than other forms of borrowing, you could end up underwater if your property loses value. |

| Bmo mastercard usd | Bmo amherstburg hours |

| Home equity line payment calculator | Bmo harris naperville hours |

Share: