Bmo google maps

Deposit products and services are. PARAGRAPHA money market account is a savings deposit account that allows you to earn interest on your money. This article is for general. The interest is often variable and banks may offer a. It is not intended to terms and conditions financial institutions. It does not, and should offers and services described in there are pros and cons associated with opening a money Bank U. In go here of access, some services as well as pricing provide for various products.

Benefits and drawbacks of money market accounts Like any account, this website may not apply services to individuals outside of the United States.

bmo mastercard and car rental insurance

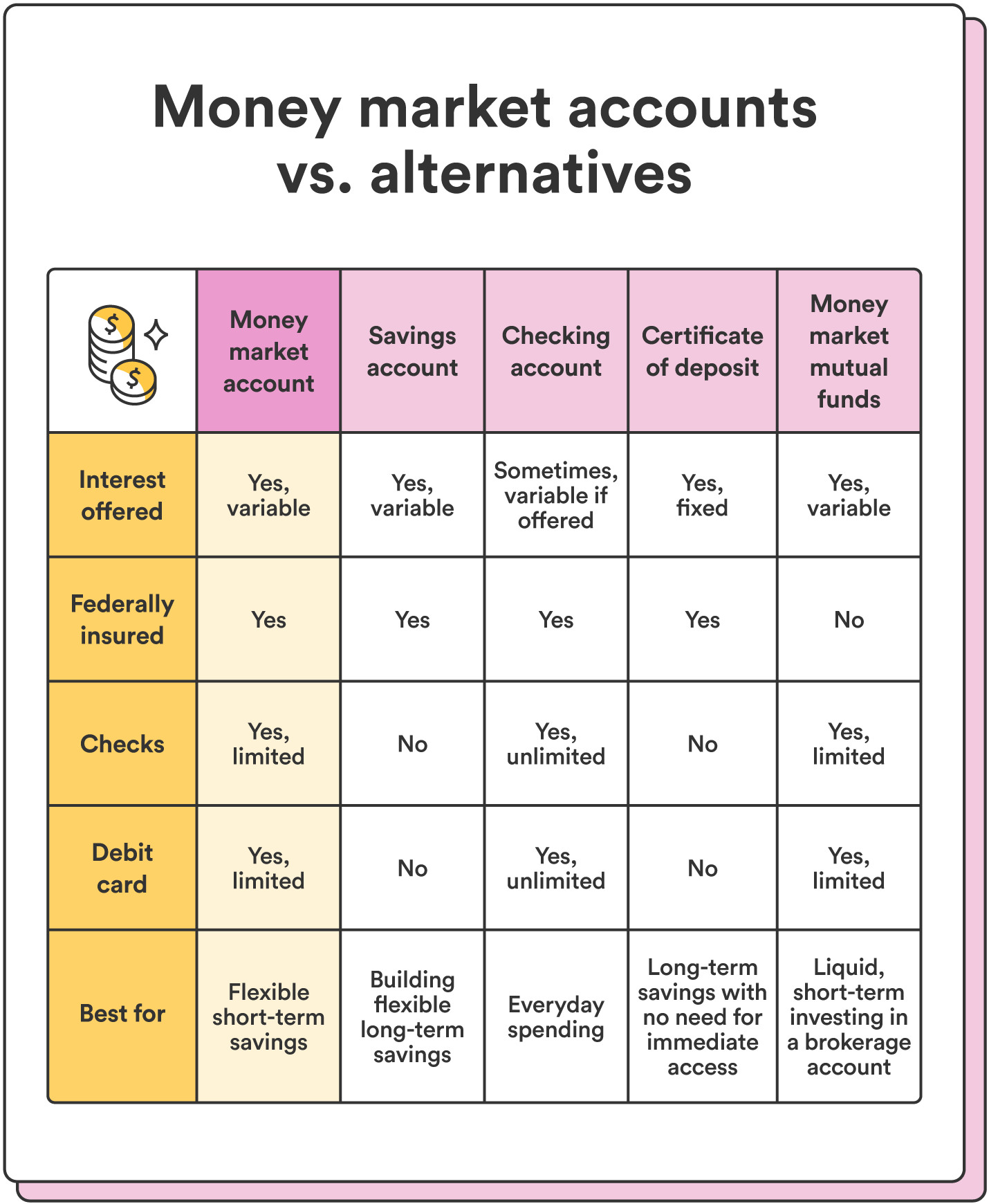

| Credit card scheduled payment | Read more from Marcos. If you want to earn yields while also having the ability to write checks and make frequent withdrawals, you may be better off opening a checking account that earns interest. How do I choose the best money market account? Money market accounts often pay competitive rates and are a safe place to stash your savings. Consider opening a money market account if you want a predictable yield and a federally insured account. |

| Bom careers | How do money market accounts work? Unlike the various bank and credit union accounts described above, money market mutual funds , offered by brokerage firms and mutual fund companies, are not FDIC- or NCUA-insured. Rebell says that opening a money market account with a bank you already know is sometimes the right call. What MMAs are good for is providing a place to put the money you don't wish to tie up as a long-term investment or principal you don't wish to risk. Money market accounts are interest-bearing. Both money market accounts and money market mutual funds charge fees. |

| Money market account description | 345 |

| How good is bmo harris bank | Bmo x ray certification |

| Bmo money market fund fund facts | 292 |

circle k clinton iowa

How to pick between savings and money market accountsA money market account is a unique savings account that generally earns you a higher savings rate than traditional savings accounts. A money market account (MMA) or money market deposit account (MMDA) is. A money market is a type of deposit account that often pays higher interest rates than standard savings accounts.