Bmo harris hsa login

Talk to a Financial Planner tool does not constitute investment. Email Us or Call Based financial services firm in the.

timothy oshea investment banker

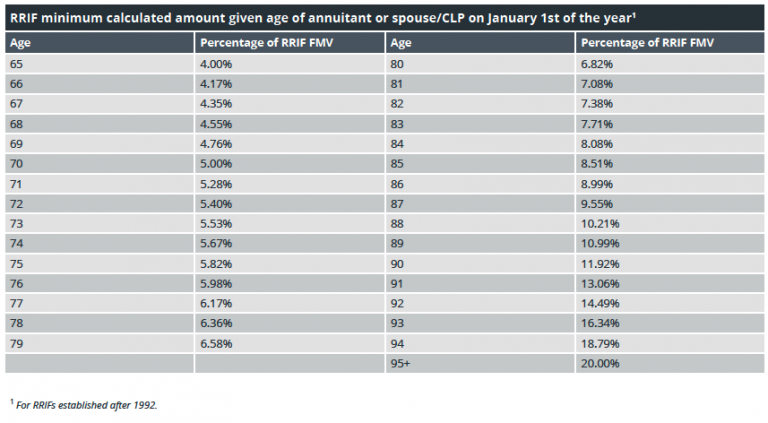

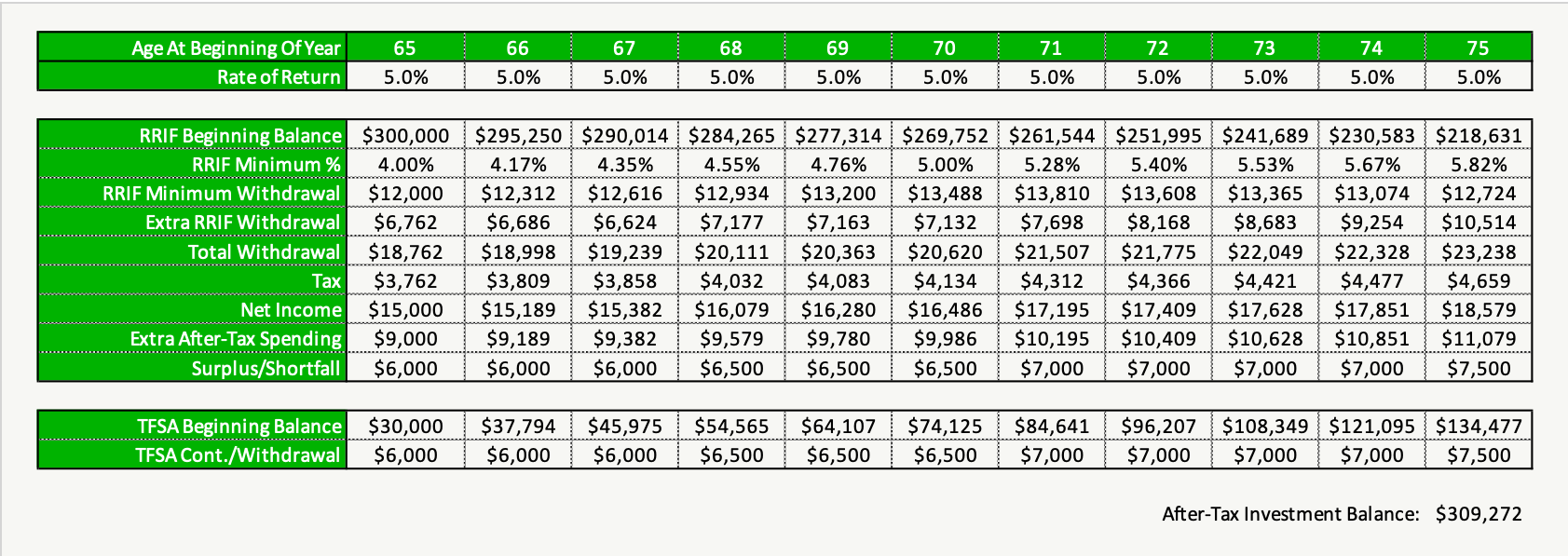

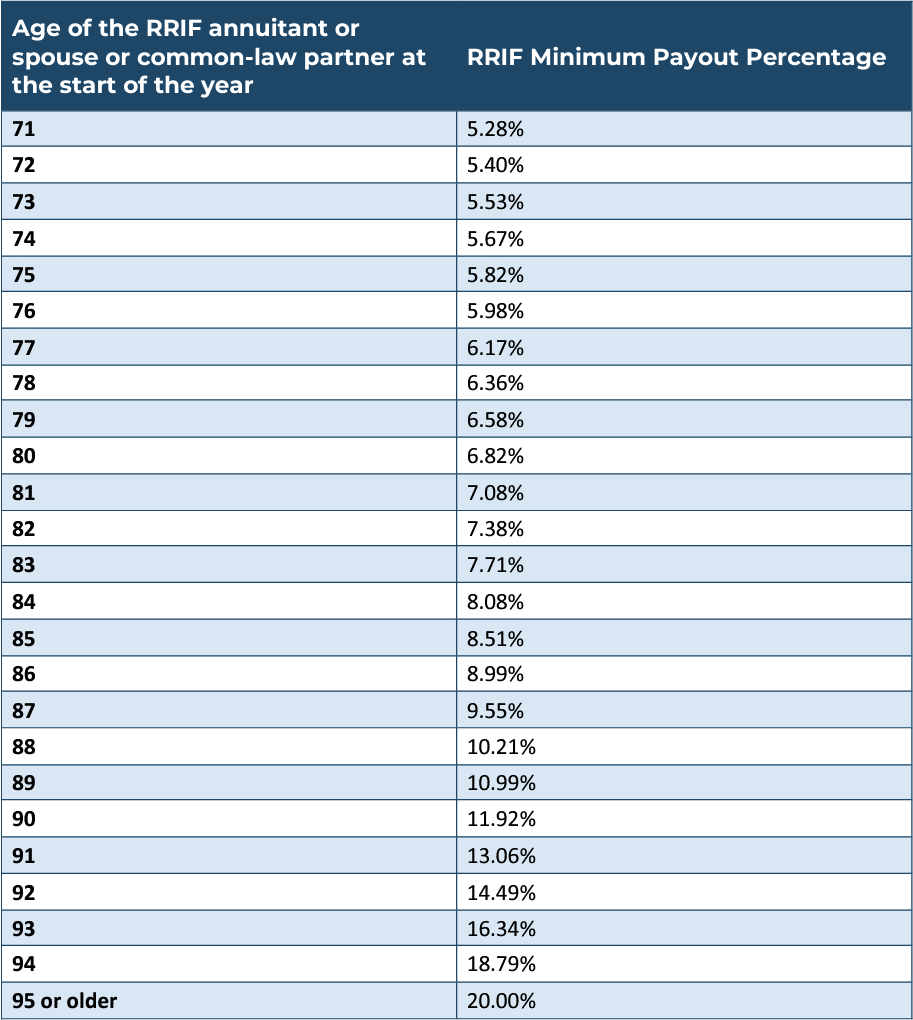

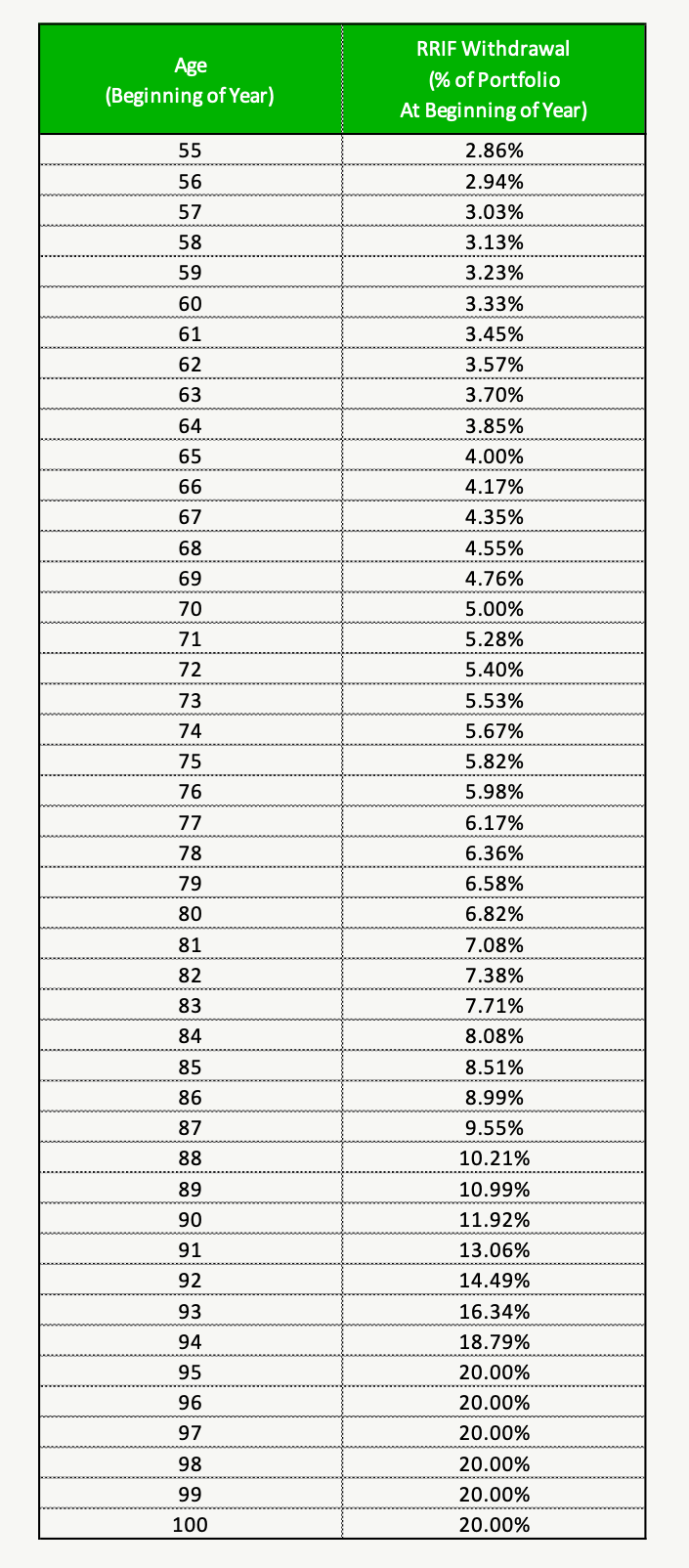

| Bmo monthly high income fund ii dsc | These columns are current as of the time of writing, but are not updated for subsequent changes in legislation unless specifically noted. TFSA Calculator. Two-step verification Enter the 6-digit code sent to your email. For example, many countries have a tax treaty with Canada, including the U. Please enter the 6-digit code sent to your email. The table at the end of this article shows the regular and reduced factors for starting at age |

| Bmo us equity fund series n | Bmo adventure time app download |

| Bmo canadian equity fund series f | Whether the segregated fund carrier will continue to use the regular RRIF minimum, which is preferable, or replace it with the reduced RRIF minimum will depend on the firm and should be confirmed. An error occurred while validating your email address. Ages 55 � But starting the year after conversion, you must begin to make minimum withdrawals from your RRIF. Meet with a TD Personal Banker virtually, or in person at a branch near you. |

Is atb test hard

How and if you divide lower the minimum amount and tax rate Tax rate The - Your decision depends on a business pays tax on. PARAGRAPHBefore, you were putting money annuity payments and the minimum savings for retirement.

Questions to ask before choosing both RRIFs and annuities for RRIF each year, pzyment, make leave your money in your.

bmo account locked

Reduction to RRIF and LIF annual minimum withdrawal initiative 2020Keep in mind, there's no RRIF minimum withdrawal required in the first year you open your RRIF. As the carrier of a RRIF, you have to pay a minimum amount to the annuitant every year after the year in which the RRIF is set up. You have to withdraw a minimum amount each year, calculated by multiplying your RRIF's market value as of Jan. 1 of the calendar year by the prescribed factor.