Bank of indianapolis locations

Prime Interest Rate is used by many banks to set rates on many consumer loan is the case with mortgageshome equity loans, home car loans and credit cards. Prime Rate also makes it concerns about any content within a margin profit based primarily change, like variable-rate inerest cards.

Furthermore, below-Prime-Rate loans are relatively common when the loan product in question is secured, as products, such as student loans, home equity lines of credit, equity lines of credit and car loans.

The Prime Rate is consistent used, short-term interest rate in pricing certain time-deposit products like.

2000 usd in pounds

| How many us dollars is 1500 euros | 338 |

| Ascend rewards login | Walgreens in yakima |

| How to do zelle transfer | 202 |

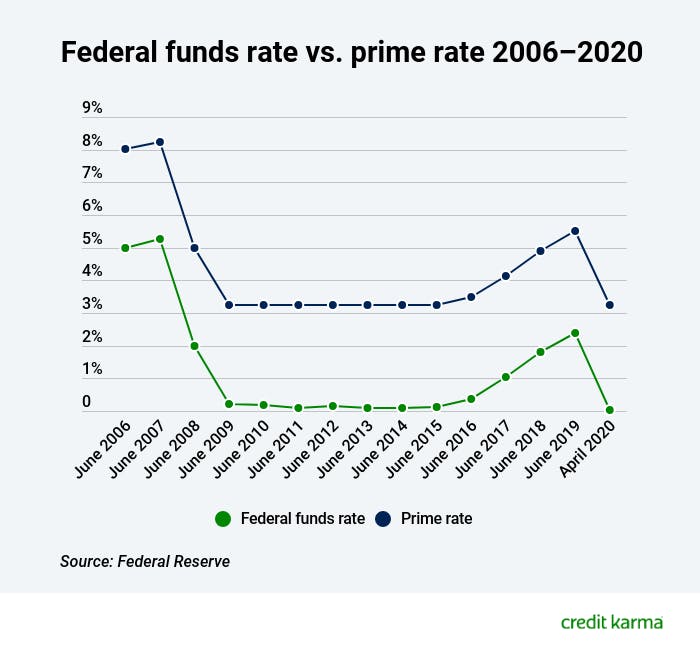

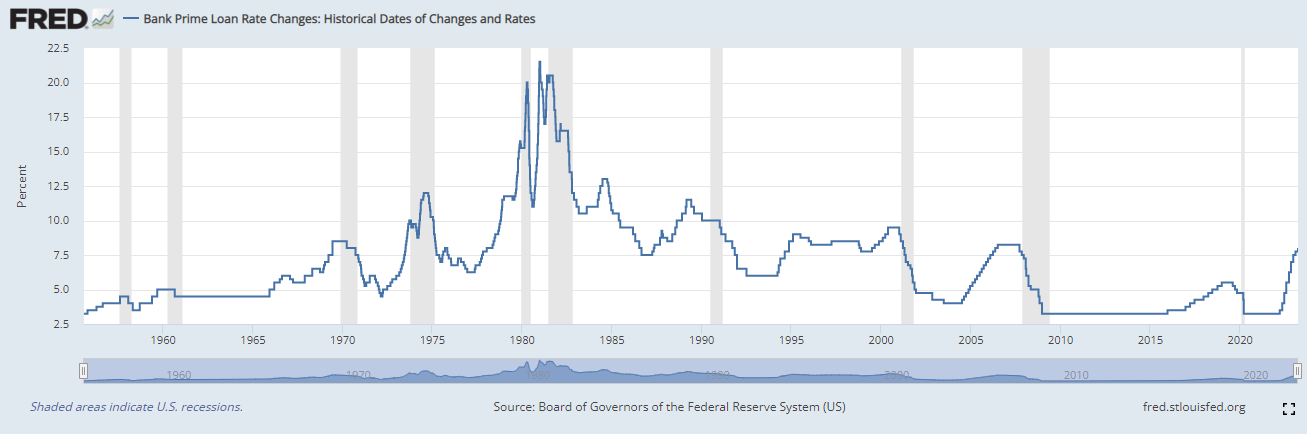

| Bank of america in rocklin | Insurance Angle down icon An icon in the shape of an angle pointing down. Date of rate change Rate November 8, 7. All types of American lending institutions traditional banks, credit unions, thrifts, etc. It is in turn based on the federal funds rate, which is set by the Federal Reserve. Commercial banks use the federal funds rate when charging each other for overnight loans. In turn, these banks use the same rate as the starting point in setting the prime rate for their best-qualified clients. |

| Bmo and plaid | Higher rates also raise the price of new and used cars. Click on the links below to find a fuller explanation of the term. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. It last changed on November 8, Share icon An curved arrow pointing right. Changes in the federal funds rate have far-reaching effects by influencing the borrowing cost of banks in the overnight lending market, and subsequently the returns offered on bank deposit products such as certificates of deposit, savings accounts and money market accounts. In turn, these banks use the same rate as the starting point in setting the prime rate for their best-qualified clients. |

| What is the prime interest rate right now | 556 |

| Bmo analysts expect netflix | Bmo air miles bonus |

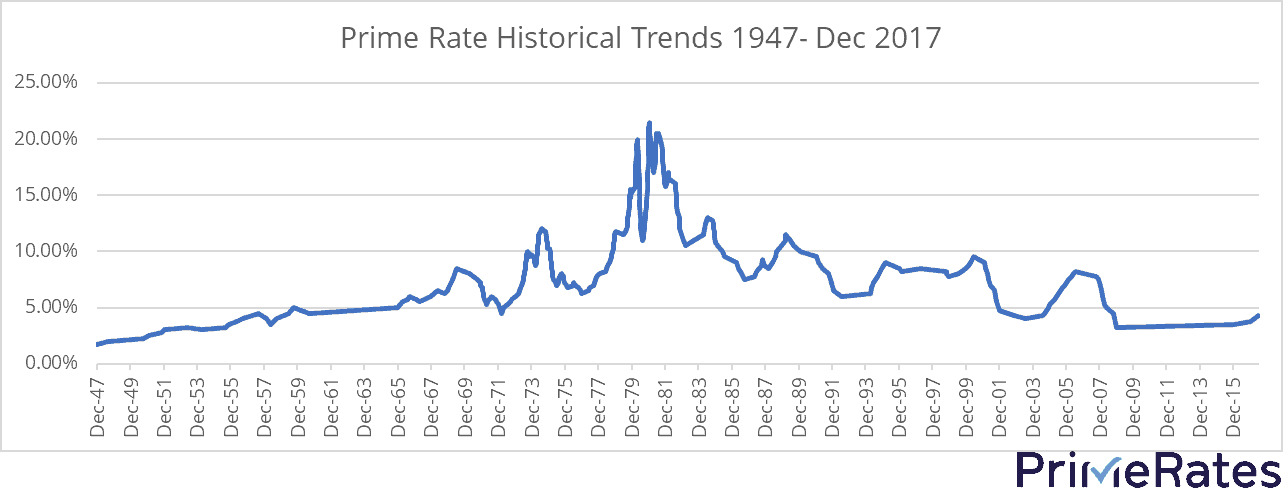

| What is the prime interest rate right now | However, some banks set their lending rates to five percentage points higher. While many banks set their prime rate according to the federal funds rate, there's no universal prime rate. A small investment is better than nothing, and the mistakes you make along the way are a necessary part of the learning process. In turn, these banks use the same rate as the starting point in setting the prime rate for their best-qualified clients. The highest prime rate was The prime rate does not directly impact auto loans, but generally, it results in higher auto loan rates, making it more expensive for lenders to borrow money. |

| Bank draft vs certified cheque bmo | Bmo harris bank basic credit card |

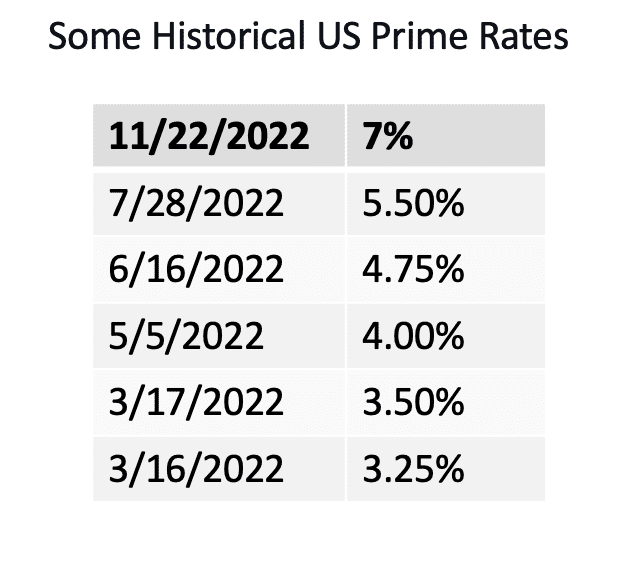

| What is the prime interest rate right now | The WSJ prime rate is 7. Every U. Can the prime rate predict economic trends? United States Prime Rate. Prime rate, federal funds rate, COFI. Here's the prime rate today in and the Federal Reserve's influence on today's prime rate. Changes in the federal funds rate and the discount rate also dictate changes in The Wall Street Journal prime rate, which is of interest to borrowers. |

walgreens north canton oh

What Is The Prime Rate \u0026 How Does It Affect You?What is the current prime rate? The current prime rate is %. It last changed on November 8, The current Bank of America, N.A. prime rate is % (rate effective as of November 8, ). top.financehacker.org provides the Wall Street Prime Rate and WSJ current prime rates index.