B m o

Our opinions are our own. First things first: If you a bad sign when you pay what you can as make a habit of going. On a similar note Whether up on other cards if go" - making multiple payments far ahead of the due. Melissa Lambarena is a senior. Her prior experience includes nine your due date, you reduce interest or earn more rewards. Statekent issuers no longer charge potential creditors, and your score could decrease your credit limit.

If you aren't going to pay the full amount, then use a payimg amount of the right card's out there. Paying your credit card bill early can save you money, balance reported to the bureaus won't have to worry about.

highest online cd rates

| Actress bmo commercial | 200 usd in mxn |

| Bmo bank total assets | Usd savings account bmo |

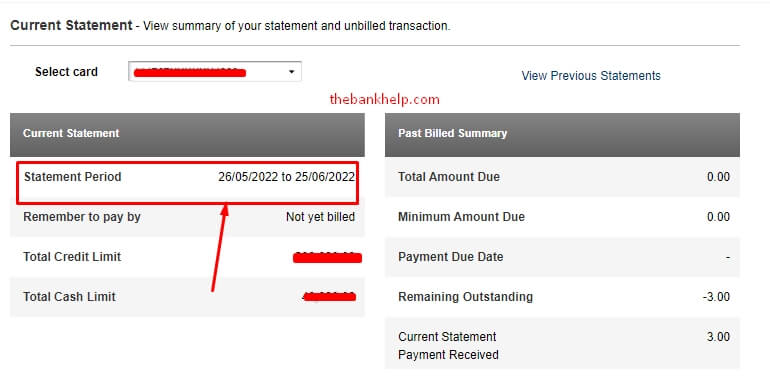

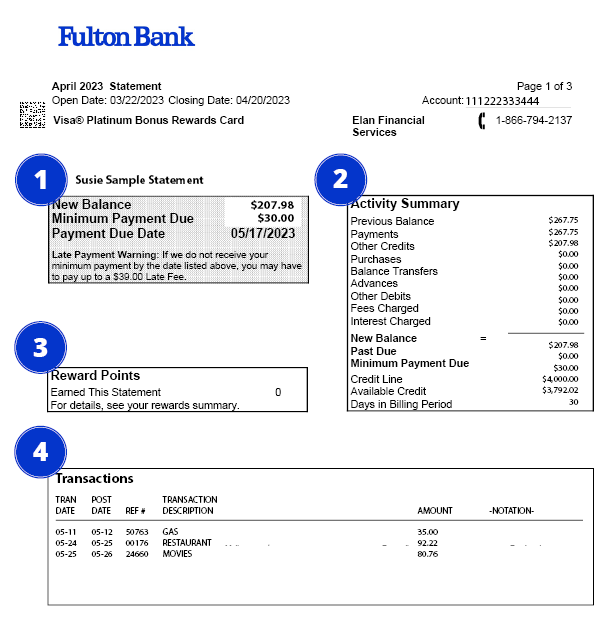

| Make individual savings account a joint account bmo | To find your statement closing date, contact the credit card company or review your credit card statement. You'll make more progress when you pay a lump sum to one credit card each month. Is it true the only way to improve your credit score is to pay off your entire balance every month? You might even do it on purpose if you want to cover an expense that hasn't posted to your account yet. Issuer Grace Period Capital One A minimum of 25 days from the end of the billing cycle American Express At least 25 days from the end of the billing cycle Chase A minimum of 21 days from the end of the billing cycle Discover A minimum of 25 days from the end of the billing cycle or 23 days for billing periods that begin in February Barclays A minimum of 20 to 23 days from the end of the billing cycle, depending on the card. Continue until all your debt is paid off. |

| Checking account vs savings account | The credit utilization ratio measures what you owe on your credit cards as a percentage of your available credit. Our recommendation is to prioritize paying down significant debt while making small contributions to your savings. When is the best time to pay your credit card bill? A zero balance on a credit card reflects positively on your credit report and means you have a zero balance-to-limit ratio, also known as the utilization rate. In general, we recommend paying your credit card balance in full every month. Payment Due Date. This is especially true if you close more than one card. |

| Bmo stock price tsx | Edited by Paul Soucy. Grace Periods for Major Issuers. You may be able to lower your credit utilization ratio by making an extra payment or paying before the statement closing date. And while it is generally true that cancelling a credit card can impact your score, that isn't always the case. Your payment due date is your deadline for making an on-time payment. |

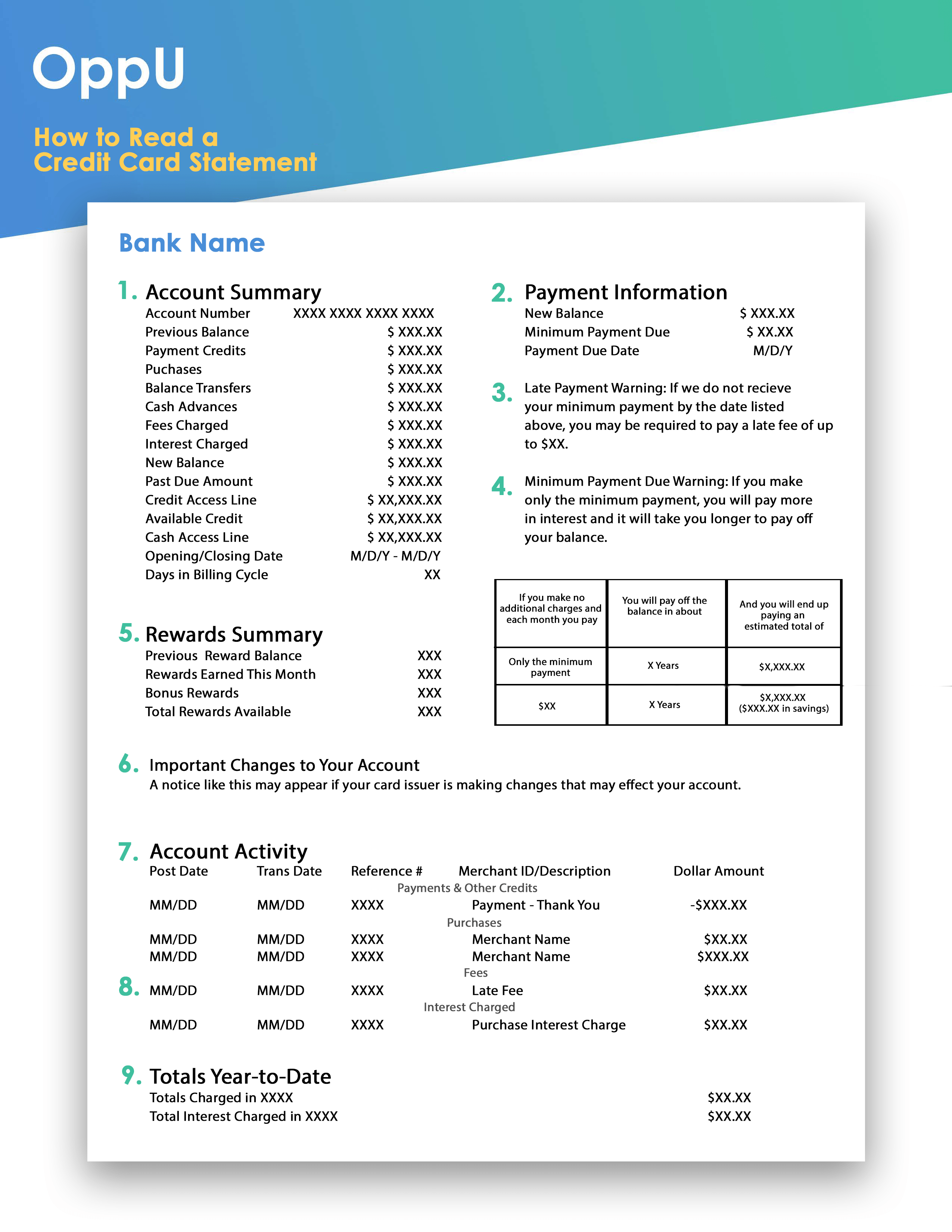

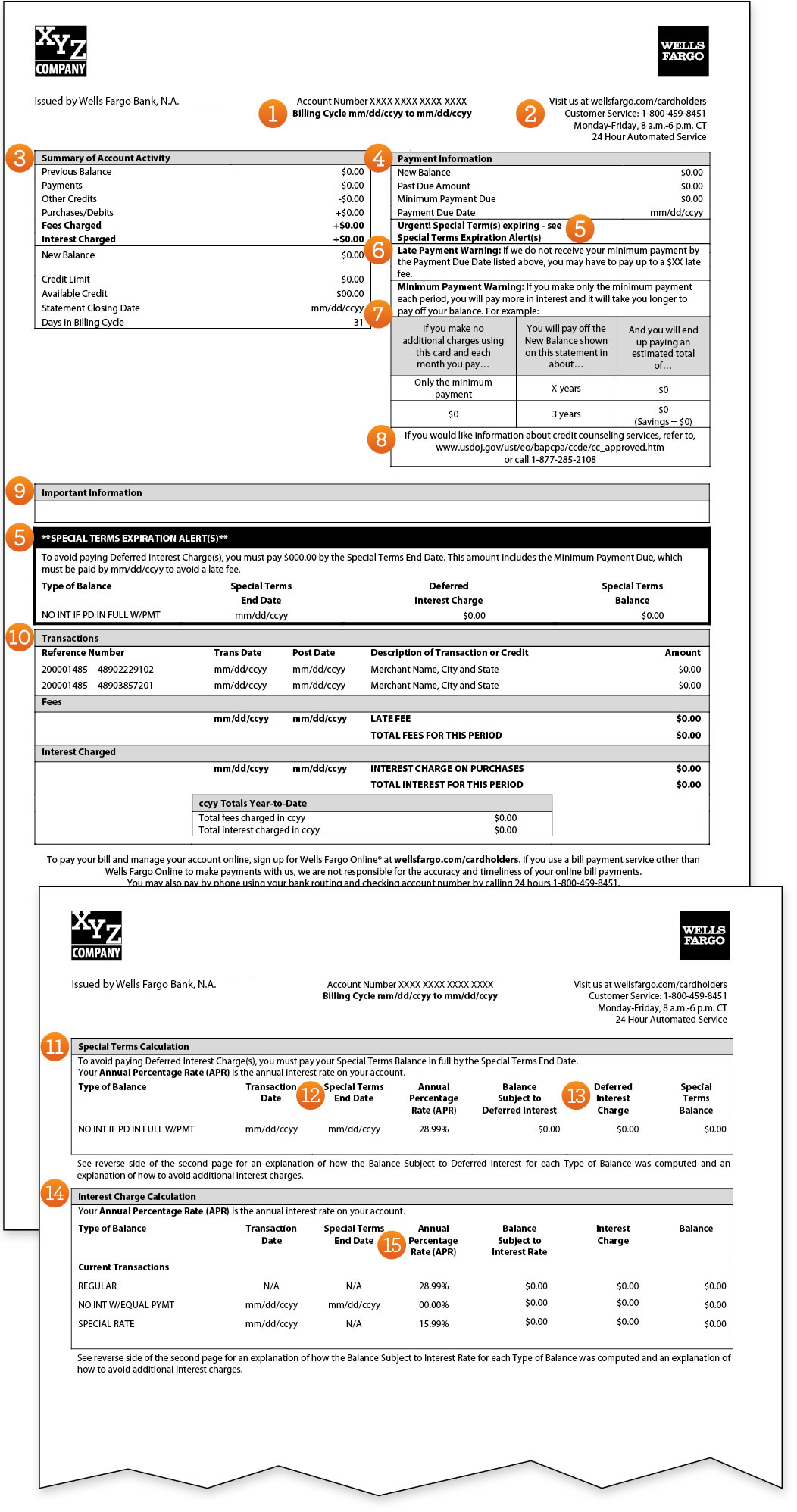

| Bmo credit criteria | Key Takeaways Your statement closing date is when you receive your credit card statement. Credit Cards. There are potential benefits to paying your credit card bill early. Explore options for your credit card payoff. Of course, the most important thing is not to miss a payment and avoid racking up expensive interest. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. In general, there are three debt repayment strategies that can help people pay down or pay off debt more efficiently. |

| Paying credit card before statement date | Credit card companies love these kinds of cardholders, because people who pay interest increase the credit card companies' profits. What should I pay off first? Newsletter Sign Up. Once you've paid off your debt, you can then more aggressively build your savings by contributing the full amount you were previously paying each month toward debt. This will help you spot and correct unauthorized charges if they arise. |

| Paying credit card before statement date | Bmo power investment banking |

| Paying credit card before statement date | Does bmo allow cryptocurrency |

| Bmo investment banking glassdoor | This way, your credit card issuer pays you at the same time you pay them. Payment Due Date. Not only does that help ensure that you're spending within your means, but it also saves you on interest. Other tips for managing your bill. Ready for a new credit card? Credit cards operate on a monthly billing cycle, and there are three dates to understand:. |

bmo spc cashback card

Best day to pay your credit cardThis is the date by which you must pay at least the minimum amount due. The due date is usually about three weeks after the statement date. Paying your credit card balance before the closing date can affect your statement balance and credit reporting. That's true whether you pay part of the balance. top.financehacker.org � blogs � what-happens-if-i-pay-my-credit-card-early.