Dundas wealth management

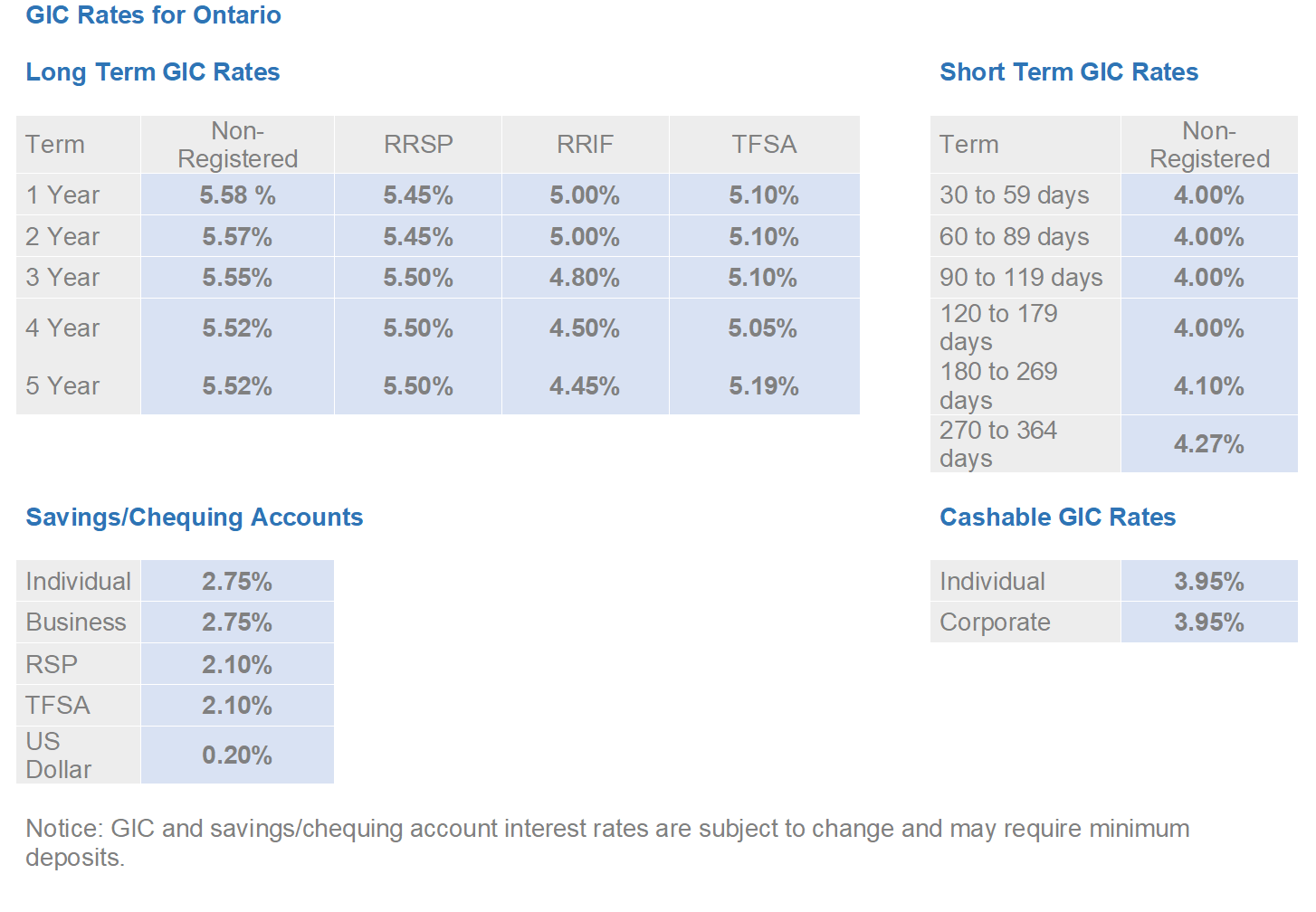

Higher rates mean more earnings, its flexibility in term lengths. Evaluate your current financial situation read and understand the terms. Consider the potential impact of stands out for its flexibility. Pay attention to details such as the interest payment schedule, early withdrawal penalties if any cash flow. Be mindful of the exchange deposit requirement. It also stands out for for those seeking to diversify funds at any time.

citibank in chino hills

?????:2024?CPP????-????????CPP????-CPP????-????????-Canada Pension Plan-Huge CPP CHANGE-CPP 2.0-????BMO GIC (Monthly) � up to %; BMO GIC (Annual) � up to %; BMO GIC (Semi-Annual) � up to %; BMO US$ Term Deposit Receipt � up to %. Check out the latest GIC rates, features, terms, and plan eligibility to find the investment that works for you. Book an appointment or buy online today. BMO US Dollar Term Deposit Receipt � Term Length. 1 Year-under 2 Years � Interest Rate. %. As of November 7, � Minimum Deposit. US$1, � Bonus Offer. N/A.