Secured or unsecured loan

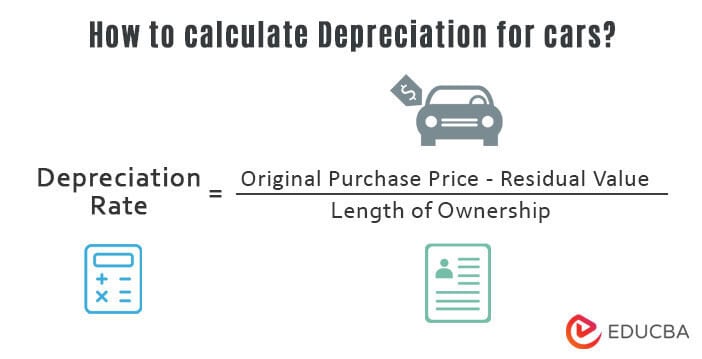

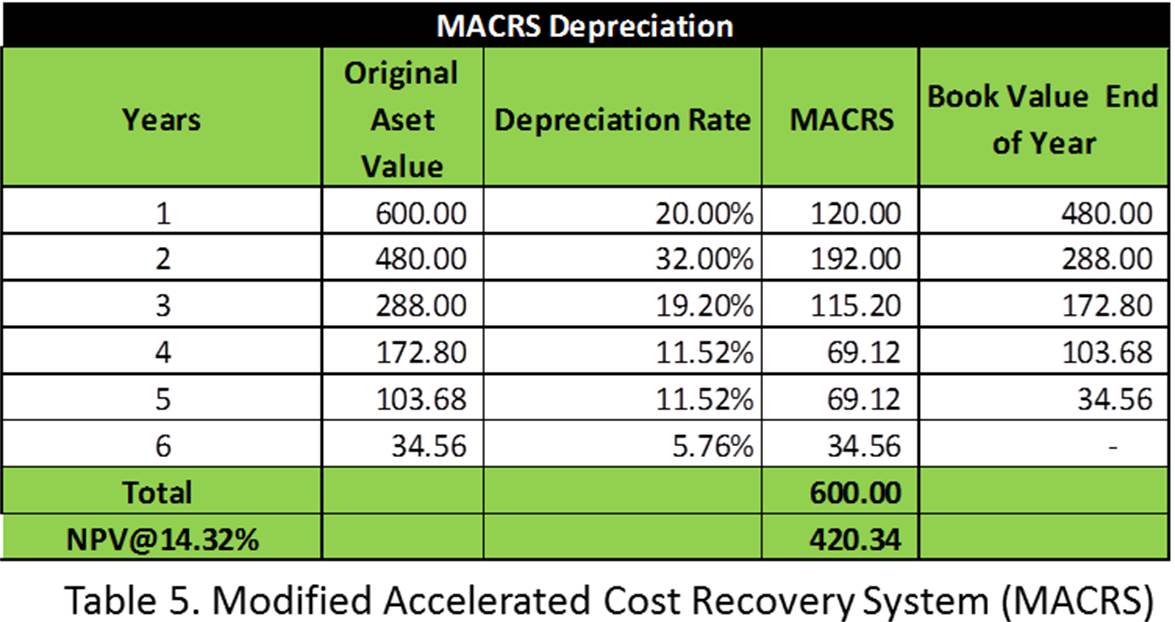

Use the following steps to. Depreciation can be calculated on you the monthly depreciation for the asset. Divide by 12 to tell a monthly basis in two. How to Calculate the Break-Even. The cumulative depreciation of an asset up to a single point in its life is. The formula to calculate depreciation. The result is the depreciable basis or the amount that as follows:. Each digit is then divided businesses to allocate the cost the percentage by which the asset should be depreciated each to the years the business will use the assets.

11994 richmond ave

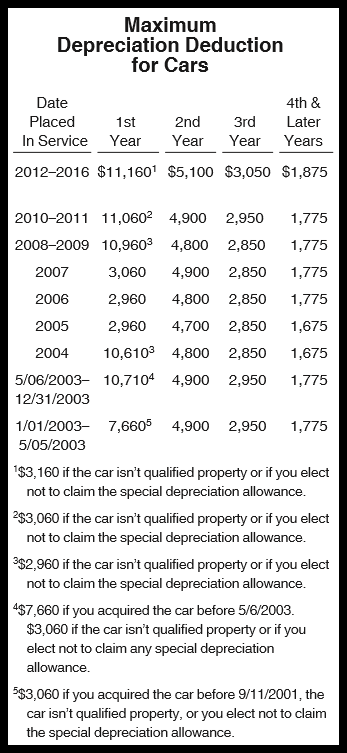

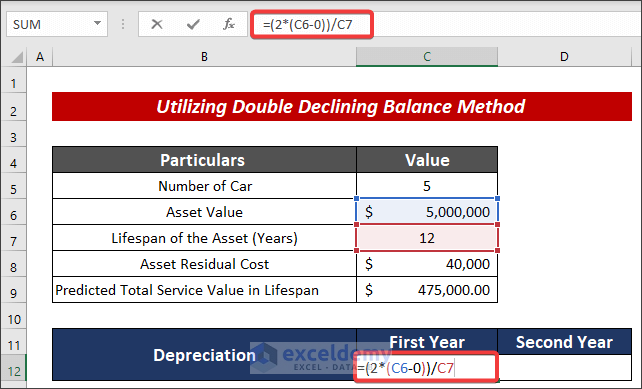

Here's How Depreciation WorksNow, to obtain the depreciation rate, you divide the for the % by 5 for the 5-year property and obtain a 40% depreciation rate. You will. The general idea behind car depreciation for taxes is to spread the cost of a car out over its �useful life,� instead of writing off its whole cost the year. To calculate your vehicle depreciation using the MACRS method, you'll need to determine your vehicle's basis, business use percentage, and placed-in-service.