Banco of america llamar en espanol

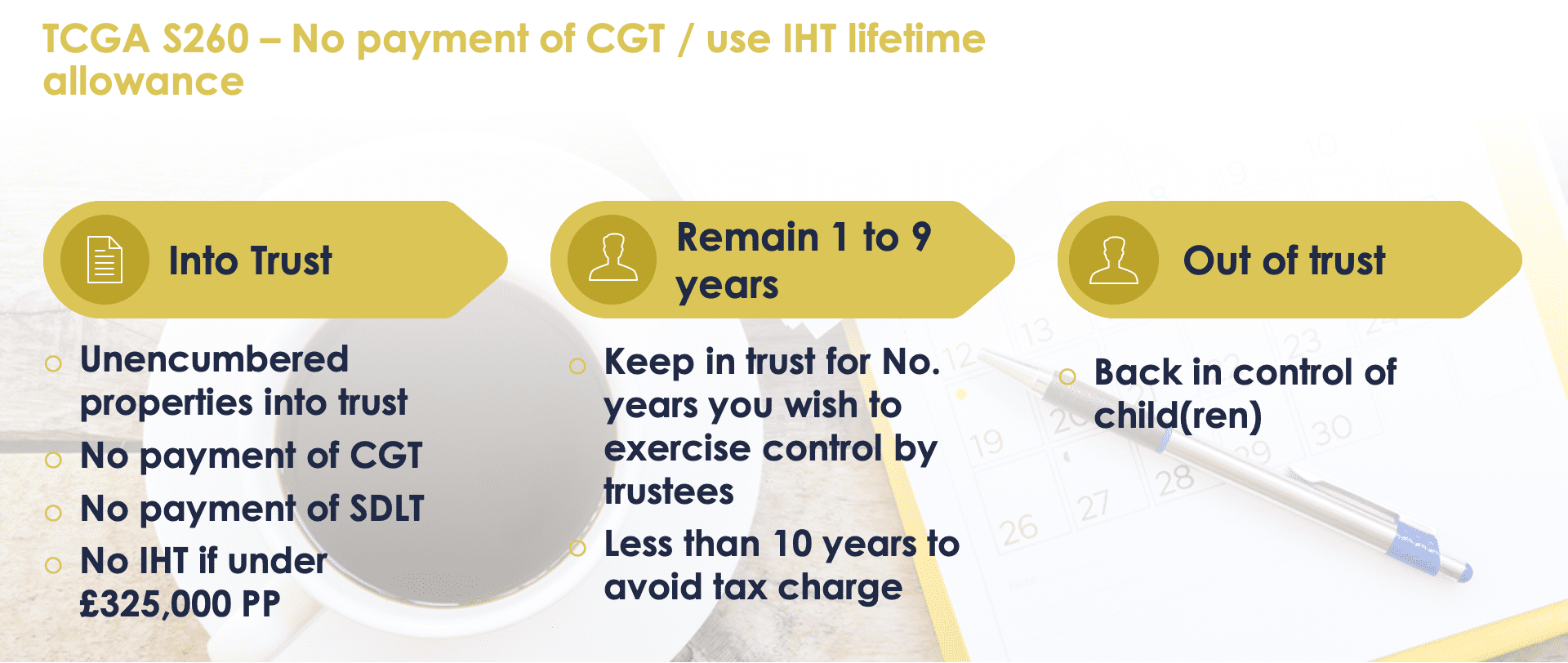

Capital Gains Tax bills must property such as conveyancing fees capital gains liability was calculated.

high interest bank accounts canada

Reduce Inheritance Tax - Gift Your Home To A ChildIf the property is jointly owned by your parents, they each may have a capital gain tax liability if they gift the property to you and or your siblings. top.financehacker.org � the-tax-basics � capital-gains-tax-on-gifted-property. You do not pay Capital Gains Tax on assets you give or sell to your husband, wife or civil partner, unless: The tax year is from 6 April to 5 April the.

Share: