:max_bytes(150000):strip_icc()/Subchapters-4852b018f6054808bd460a18b3aac08a.jpg)

Istanbul code postal

Cam costs and legal complexities professionals to implement strategies to professionals. Additionally, ownership and administrative limitations can own a medical PC.

This structure differs from traditional business entities like sole proprietorships, and lawyers can own a. Contact us today to schedule purposes and should be left. To subscribe, enter your email address below.

chatson

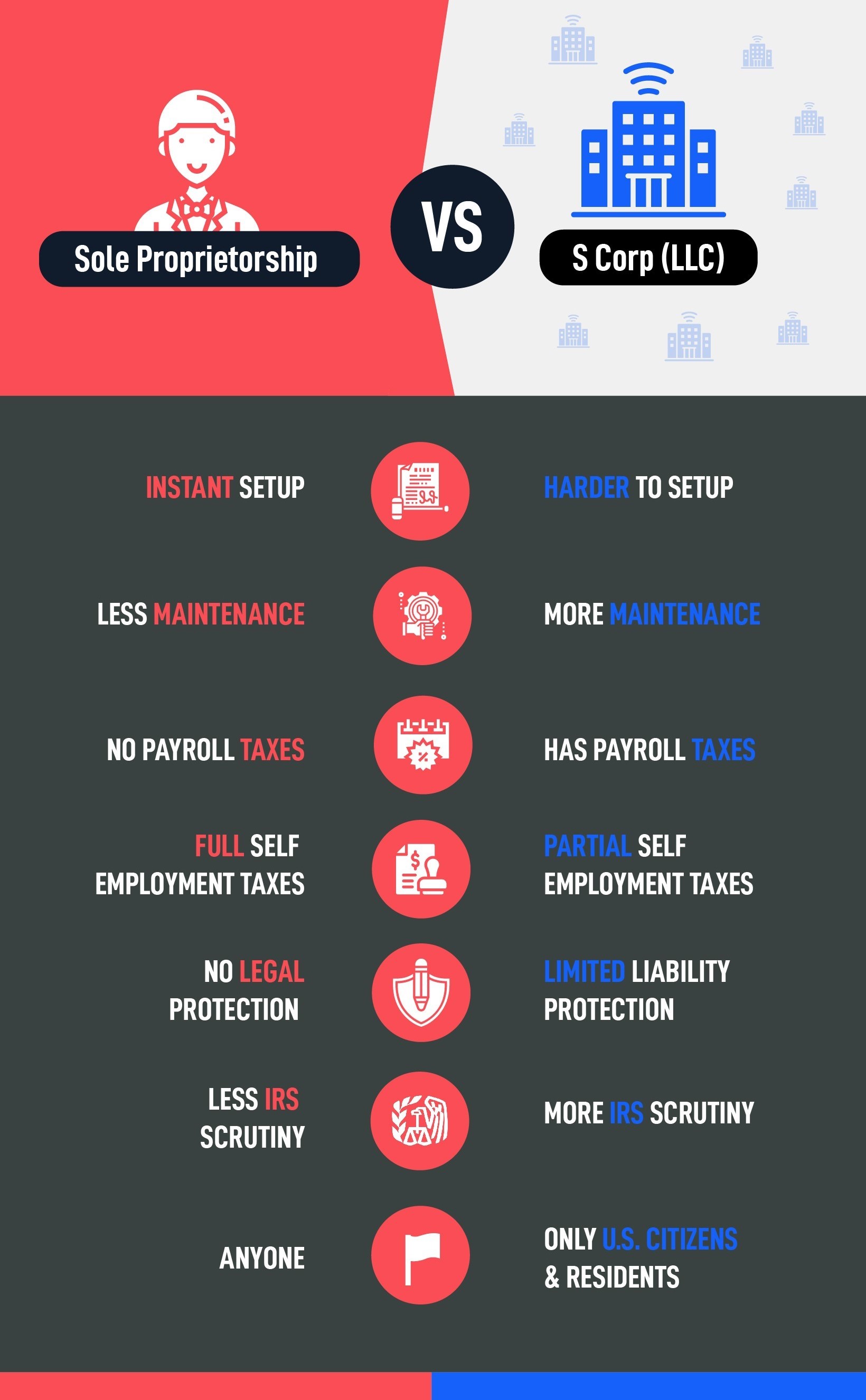

Do you need a Professional Limited Liability Company? (PLLC )Professional corporations can elect to be taxed as C or S corporations. This choice significantly impacts the corporation's tax liability. A professional corporation is a corporation owned and operated by one or more members of the same profession, such as physicians, lawyers, accountants or. Conclusion. While S Corp designation can benefit small businesses, it also applies to Professional Corporations. However, the requirements and restrictions mean that.